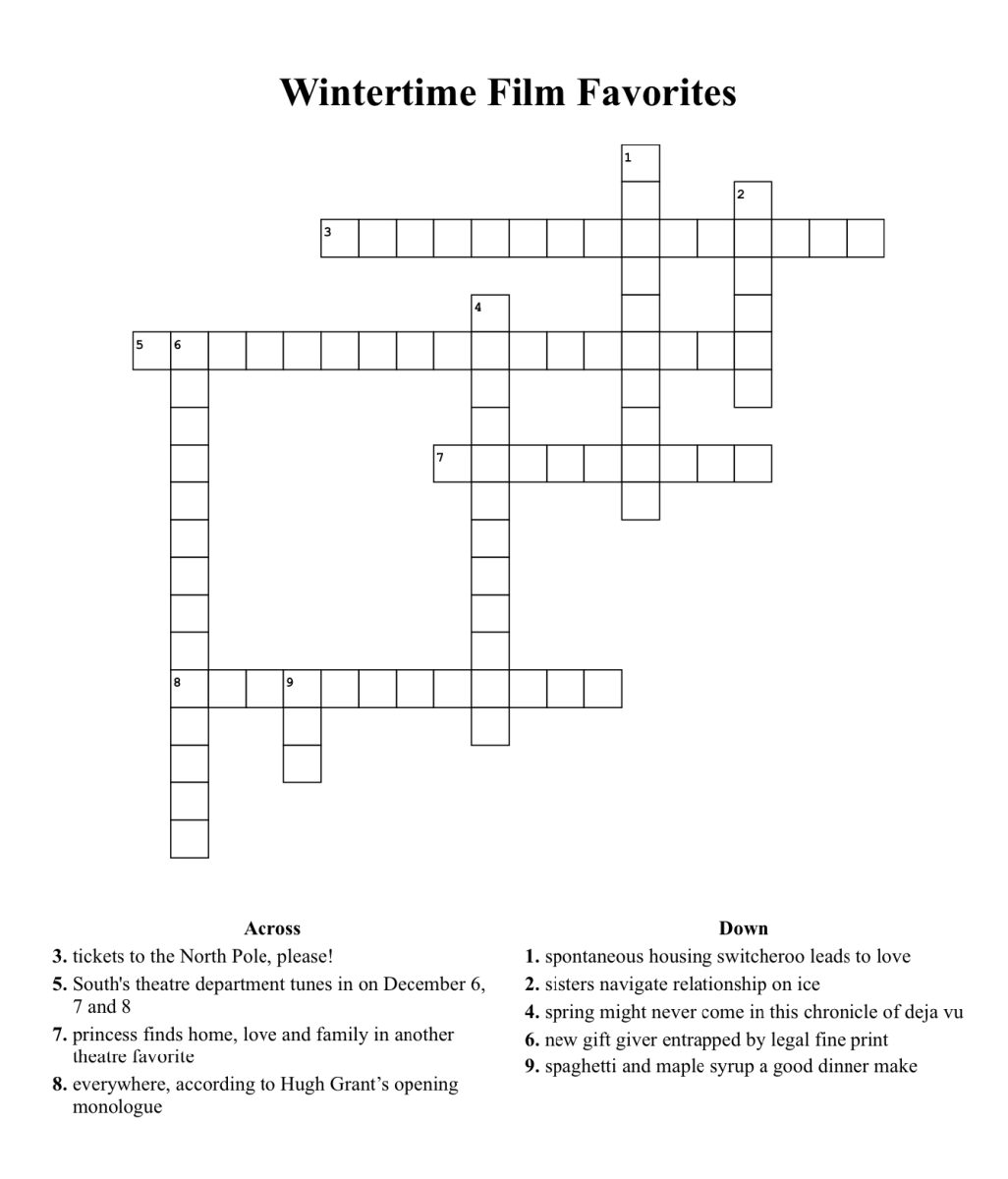

Student Debt: Should Taxpayers Be Involved?

https://dcist.com/story/21/07/20/d-c-council-gives-initial-approval-to-raising-taxes-on-high-income-residents/

September 29, 2022

The phrase “no taxation without representation” was a rallying cry of many American colonists during the period of British rule in the 1760s and early 1770s. The slogan gained widespread notoriety after the passage of the Sugar Act on April 5, 1764. Recently with new plans and ideas coming out, it has raised a question in the air: why should I be paying for this?

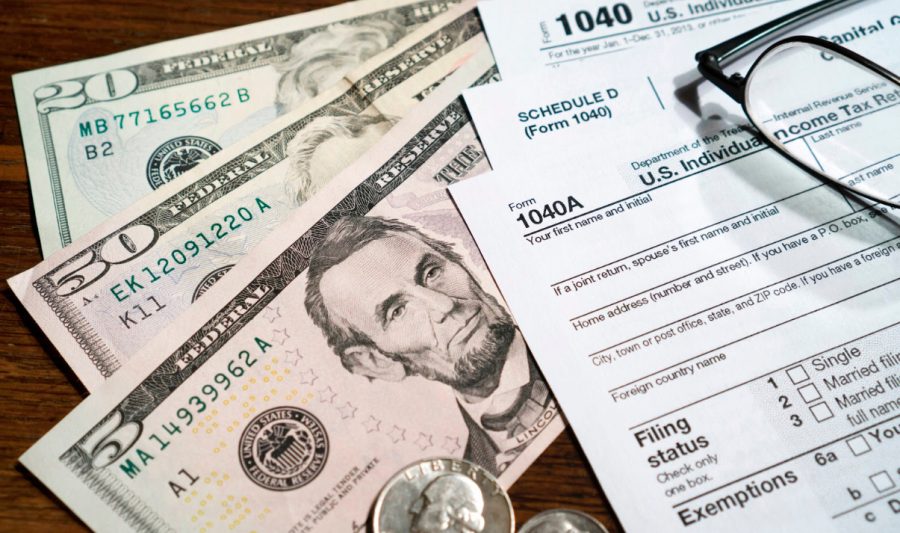

President Joe Biden has announced a new plan to help give relief to low and middle-income families who have remaining student debt loans to pay off. Borrowers who make less than $125,000 a year are eligible for this plan. Although it brings a sense of hope to individuals who are still paying off their loans, taxpayers are not exactly pleased.

Borrowers will not have an increase in taxes, while those who are not part of the plan will see a slightly higher amount that they need to pay in state taxes, which is due to the money the government is giving away to help relieve the debt. In simpler words, the government needs to earn its money back. Even though the increase in taxes is only a tiny amount, the National Taxpayers Union estimates that over the course of 10 years, the taxes will add up to about $2,500 per taxpayer.

Many people have also argued that the student forgiveness plan is reasonable since everyone essentially pays taxes to pay for the previous generation’s retirement.